This year at the RA’s Summer Exhibition there were 1602 works of art exhibited from c.1200 different artists - across x12 different rooms.

I’m always conflicted about my enjoyment of the Summer Exhibition as the density of work makes the enjoyment quite challenging. But I guess that's the point; a celebration of art and an opportunity for artists to get their art shown in a prestigious environment.

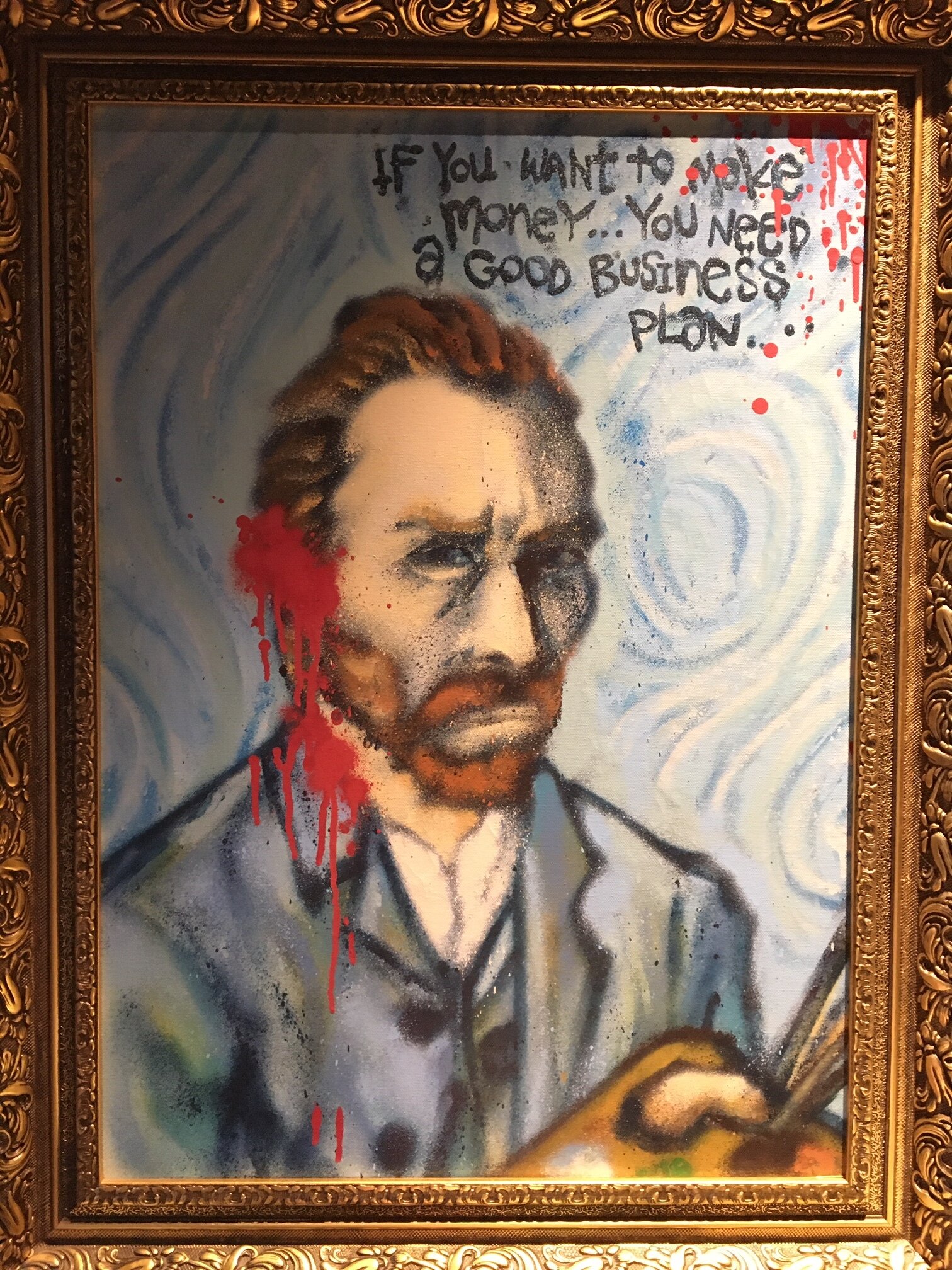

What it does always do is remind me of the huge number of artists in the world there are & (wearing my capitalist hat) also what a mine field the idea of investing in art is.

Here’s some notes I jotted down whilst wandering through the RA on the subject of 'art investment' …

Buy what you like / market illiquidity

The maxim of ‘buy what you like’ is ever important when it comes to art investing as unless you’re buying a blue chip artist then it is highly unlikely that you’ll ever be able to sell your work of art - as the secondary market for art is so limited. At a rough estimate 1 in 25,000 artists will have a viable place in the secondary market (ie being able to re-sell your work at auction at any kind of value).

This is why people will always say ‘buy what you like’ - because in most cases there’s quite literally no way of selling it / realising value.

Unlimited supply / zero intrinsic value / 100% brand value

There is no intrinsic value in a piece of art. With property there's land value. With a business there's cash flows. With art there's quite literally nothing. It's a 100% brand value play in a world in which there's unlimited supply of art. (As a reference point there were 1200+ artists alone showing at the RA's Summer Exhibition - one of the world's most prestigious exhibitions. There must be 50,000+ artists in the UK alone / c.5 million + in the world)

The reality is is that you could pay £5,000 for a painting that if you needed to sell it - you might only be able to realise it’s ‘wall space value’ ie £100 / £200 (depending on its size).

Market makers & manipulation

Art value = brand value. And just as LVMH control the price of handbags, similarly the big galleries like Hauser & Wirth control the price of art.

Blue-chip / Brand matters

And just as a the price of a Louis Vuitton bag is x100 more than your average bag, so a Picasso or Nicolas Party are priced at x100 / x10,000 than your average local art school artist. Brand matters.

(Disclosure: I have personally benefited from the ‘brand effect’ in art, as the owner of a Nicolas Party portrait that is now valued at hundreds of thousands of pounds - many multiples of the price I originally bought it for in 2014. The value multiplying considerably after the artist was signed up by Hauser & Wirth)

Image of The Nicolas Party portrait (2013) in my own collection.

Size matters

But one thing that is consistent in all parts of the market - art school or blue chip artist - is that size matters. The bigger the piece / the more wall real estate it covers, the more you can (in theory) sell it for. That said, the Mona Lisa is notoriously small.

Letters matter

Art from RA artists at the Summer Exhibition carry a premium. As a rough guide RA artists’ work are priced at between x2 to x5 times the value of a non-RA artist.

I guess the rationale of this is that RA acts as some kind of ‘quality mark’ - though in reality this doesn’t necessarily act as a ‘value guarantee’.

Death helps

Scarcity is a key dynamic in any market, and so death can really help the price of an artists's work. As reference, I first went to the Summer Exhibition c.8 years ago with my mother. Back then we both admired an artist called Anthony Green. Back then his work was selling for c.£4k a piece. This year he died. His work now sells for c.£20k +. Death talks in the art world . ..

Anthony Green’s x2 pieces available at the Royal Academy ‘23 for £17k to £21k

The haves & the have nots

Representation has a huge effect on an artist’s value. The Big Name Galleries control supply and demand. For the artist they create demand from a flow of wealthy buyers. For their clients they provide a controlled supply of ‘the best’ artists.

In a world in which art has no intrinsic value - the Galleries act as a kind of gold standard / benchmark. The galleries are a brand marque in themselves. In the same way that having RA next to an artist’s name does - but on a different level.

The big difference here is that the galleries drive the commercial demand of an artist, and help create a secondary market for re-selling their artist’s work - ensuring work maintains a ‘value’ as a tradeable commodity.

Institutions = the ultimate validator

The final piece in the pie are museums aka ‘institutions’. Fundamentally if an artist is deemed good enough to be shown at a public gallery and even more importantly bought by a gallery to form part of their collection - then that’s the ultimate validator and value creator. Happy days ;-)